30/09/2023

Saffron Export Statistics, Export Potential vs. Real Data and Export Flow to Asian Destinations

According to the latest reports published on international trade center, Intracen.org, we intend to check and analyze the saffron export volume and Iranian saffron export potential to the top saffron destinations in Asian countries.

These reports are based on several concepts, which will be defined in following lines. Then, we check the statistics and approximate information shown on charts and compare them with commercial facts, based on official export data and the process of Iranian saffron shipment through direct and indirect routes. The information on these charts is subject to dramatic changes, which requires more detailed analysis on reports provided by international trade center, with respect to the fact that some of the countries mentioned in this report face trade restriction with Iran, especially in importing saffron and export of goods to such destinations are done through middle countries and indirect routes.

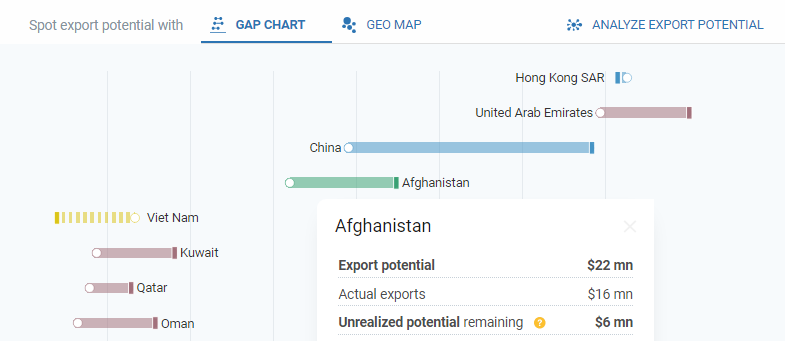

According to this report, which probably refers to 2-3 years ago, the main saffron export destinations in Asia, based on the direct export volume, are as follows:

- Hong Kong

- UAE

- China

- Afghanistan

- Vietnam

- Kuwait

- Qatar

- Oman

- Macau (China)

- Bahrain

- Taipei China

- India

- Japan

- Turkey

- Iraq

At the end of this post and based on the real data we will show that the order of these destinations based on export volume will be different as there are some differences between these statistics and the reality of Iran saffron export flow. The order of them based on ease of trade will be checked in other blog posts.

Definitions:

The below definitions are derived from the Intracen glossary page:

Export Potential: Potential export value of product k supplied by country i to market j, in dollars, is calculated as supply × demand (corrected for market access) × bilateral ease of trade.

Actual export: The value of actual exports is calculated as an arithmetic average of direct and mirror data of reliable reporters over the past five years.

Gap: This is the extent to which potential exports deviate from actual exports. Actual exports may be higher or lower than the expected potential value.

Iranian saffron export to Hong Kong:

First of all, take Hong Kong chart as an example. Based on the statistics derived from Intracen website, the saffron export rate from Iran to Hong Kong was something near 36 million dollars, at the time the report was published, while the Intercen platform estimated Iran saffron export potential near 35 million dollars. Yet, as you can see, Hong Kong charts looks like a short and reversed chart comparing to other ones, therefore, a negative export potential in this country has been formed. In other words, Iranian saffron export to Hong Kong, at this time, has been saturated and reached a figure beyond the expectations.

If you have been actively working in saffron industry in recent years, you will notice that due to trading restrictions between Iran and China, used Hong Kong as a middle country to export saffron to China. This is why too much saffron was exported to this region. This information cannot be seen using this chart and you need to have long experience and updated information to know the difference between charts and the reality of these statistics. Now, if the international trade center could specify part of this indirect export route to direct way of Iran-China, the gap figure would be a figure less than this. As a result of this, the unrealized saffron potential export to China would be a figure less than 14m.

Iranian saffron export to United Arab Emirates (UAE):

Taking a look into UAE country charts, the UAE export potential is estimated by 40m dollar. According to trade statistics, a large volume of this potential has been used and the real export rate to UAE was 35m dollar at the time of writing. Therefore, we can assume 5m dollar export potential for this country.

The above chart has classified the countries based on our saffron export rate to those destinations. In this chart, the UAE is placed in second position. From a realistic perspective, you can notice that UAE does not fit for this position in terms of export potential as the local demand is much lower than the amount exported yearly, and a large part of this saffron is re-exported to other countries such as European countries, India, Saudi Arabia, etc. UAE is only considered as a middle country with high level of ease of trading conditions for many businesses and industries.

For example, taking a look at the India export potential, you’ll know that near 14m dollar unrealized saffron export potential is considered for Iranian saffron export. While due to high tariffs of direct import of saffron from Iran, Indian saffron importers supply the required saffron through indirect, most probably illegal routes, such as UAE and Afghanistan. As a result, Iranian export companies take advantage of India market potential fully. According to yearly statistics, 30 to 35 tons of Iranian saffron, equivalent to 30-35million dollars’ worth, is imported to India from direct or indirect ways, which is twice more the estimated potential by Intracen platform.

As a conclusion, UAE plays an important role as Iranian saffron intermediate country. Most European and American costumers are willing to buy Iranian saffron from UAE origin instead of Iran, for international sanctions on money transfer and shipment of goods.

million dollars’ worth, is imported to India from direct or indirect ways, which is twice more the estimated potential by Intracen platform.

As a conclusion, UAE plays an important role as Iranian saffron intermediate country. Most European and American costumers are willing to buy types of Iranian saffron from UAE origin instead of Iran, for international sanctions on money transfer and shipment of goods.

million dollars’ worth, is imported to India from direct or indirect ways, which is twice more the estimated potential by Intracen platform.

As a conclusion, UAE plays an important role as Iranian saffron intermediate country. Most European and American costumers are willing to buy Iranian saffron from UAE origin instead of Iran, for international sanctions on money transfer and shipment of goods.

Exporting saffron to Afghanistan

According to Intracen, Iranian saffron export potential to Afghanistan is estimated by 22 million dollars, 16 million of which is related to actual export in the year that this report is published. As a result, the unrealized export potential for this market is near 6 million dollars. This raises a question:

How much is saffron demand in Afghanistan local market that requires Iranian saffron companies to ship Iranian saffron to Afghanistan, despite of Afghanistan producing 20-25 tons of saffron yearly? Have you noticed the real saffron export data from Afghanistan to other countries? This country exports more than 50-million-dollar worth of saffron, equals near 50 tons, while it only produces half of this figure.

As a conclusion, you can see the paradox between published statistics data and the reality of Iranian saffron export flow

Yet Afghanistan, as an emergent country in terms of saffron production, has banned saffron import from Iran. It is worth noting that near twice the estimated export volume (32 million dollar) is imported from Iran origin via smuggling and unofficial ways, in recent years.

70 percent of the imported saffron to Afghanistan is re-exported to India, as we talked about earlier. This usually happens as Indian traders are unwilling to pay 38% tariff on importing Iranian saffron, therefore they prefer to supply this product, indirectly, from Afghanistan route (Afghanistan origin) with zero percent tariff rate. This export route is risky for Iranian companies because of ban order to import saffron to Afghanistan, while the Indian party bears no risk at all.

The above chart relates to the real data and saffron export potential from Afghanistan to other Asian destinations. This chart approves parts of our market analysis insight. The data and statistics in this chart are related to 2-3 years ago, during which the saffron export from Afghanistan has increased.

Exporting saffron to Vietnam

The Iranian saffron export potential for Vietnam is estimated near 1.6 million dollars, yet this chart shows that near 4 times more Iranian saffron is exported to this country. These statistics reached to more than 25 million dollars annually in a 3 to 4 years’ time due to trading restrictions and direct saffron export to China. This shows that Vietnam played an intermediary role to trade Iranian saffron, while they have shown signs of improvement in saffron consumption culture. From our point of view, Vietnam, as a developing market in saffron industry, has a great saffron export potential of yearly 3 to 4 million dollars and more aiming to re-export to more destinations.

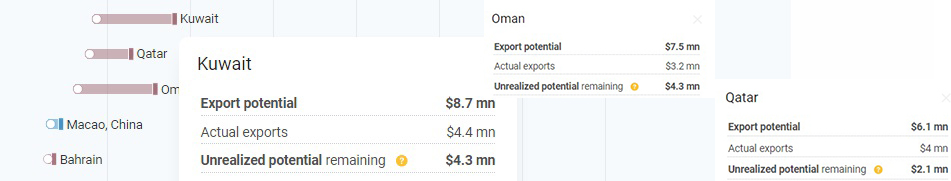

Exporting saffron to Qatar, Kuwait, and Oman

In trading saffron with gulf Arab countries, factors such as cultural and religious mutuality, mutual taste and ease of trading influence the development of these export market. These three countries, with overall saffron export potential of 22 million dollars, are considered as growing markets for this Iranian product. However, we believe near 40 to 50 percent of this potential is estimated and even the real export to these countries is done to re-export goods to countries such as Canda, USA, and Saudi Arabia, which has trading restrictions with Iran.

Direct and indirect export potential of Iranian saffron to India

According to the data and statistics in this chart, which has overlooked market facts, the export potential of Iran saffron to India is near 15 million dollars yearly, while according to the export data near 1-million-dollar saffron export is considered for this market. Also, the unrealized saffron export potential for Indian market is 14 million dollars, equal to 14-15 tons of saffron.

Sadly, these data, published by international trade center (Intracen), are not even close to real statistics, which indicates that about 30 to 35 tons of Iranian saffron (about 30 million dollars) is exported to India through direct and indirect ways of UAE and Afghanistan.

Yet, from our point of view, considering the large potential in India, which is more than 30 million dollars, this market has the potential to grow by more 20% in future years.

Final Word

Considering the Iranian saffron data interpretations in the Asia, and based on unofficial data and trading realities, it can be concluded that China and India are the largest markets for Iran saffron export. Saffron buyer companies in these two countries have been able to purchase this valuable product from direct/indirect ways. Yet, we shall not overlook the key role of UAE and Afghanistan to ease trading saffron in Asia. Especially UAE plays an important role to facilitate legal trade of Iranian companies with most countries.

The significance of Gulf countries including Oman, Qatar, and Kuwait and their market volume was analyzed, but we didn’t mention Saudi Arabia as one of the main countries which is interested in Iranian saffron. As there has been no trading relationship between Iran- Saudi Arabia, so there was no direct export between the two countries. It is worth mentioning that Saudi Arabia was one of the best Iranian saffron buyers in previous years. Now with the improvement of diplomatic relationship between these two countries, we can assume great future prospective to develop direct business with this country. In future posts, we aim to analyze the ease of trade with Asian countries, based on international trade center features as well as export potential and statistics to other European and American countries.